PINNACLE POINTERS

Pinnacle Pointers are sent to your email on Fridays.

The Importance of the Time of Day

As members of the Pinnacle Institute, you know the importance of rules, and how strict we are in following them. Rules develop a process, and they also remove emotion if we choose to stick to them. Nobody has a crystal ball, and the market can only be predicted to some degree. Therefore, probability must always be stacked in our favor. The Pinnacle methodology of qualifying zones and ensuring the risk to reward potential of our opportunities is critical to ongoing consistency and trading success.

In the Pinnacle Method, there is a step-by-step process of identifying and qualifying trading opportunities ahead of time. There is simply no excuse for jumping into the market without a plan. Behavior of this nature represents the mentality of the novice. We must approach the market as professionals, waiting for price to come to us with the intention to buy at demand and sell at supply. This process is the foundation which lays the ground for everything else. However, depending on what we trade, and when we trade, there can be additional filters or ways to stack the odds in our favor, if we approach our analysis in a logical manner. ‘

A logical approach that we employ in our Open Exchange sessions is the use of Regular Trading Hours (RTH) vs Extended Trading Hours (ETH). In previous articles, we detailed how and why RTH charts are preferable to ETH charts. If you remember, regular trading hours incorporate the hours of 9.30am to 4pm ET, the regular US Stock Market hours. Extended hours are the hours outside of RTH, and are mainly used when charting Futures markets, as these often trade 24 hours a day for almost 6 days a week, much like Forex.

We focus on using the RTH charts when day trading Futures in the Open Exchange. The zones and levels we find during the regular trading hours, typically comprise of greater volume. This means that they potentially have a greater probability of holding when tested, as they were created with greater volume in the first place. In simple terms, these supply and demand imbalances resulted from large discrepancies between the buy and sell orders of major institutions and banks. Such entities have huge buying power, which ergo leads to larger reactions.

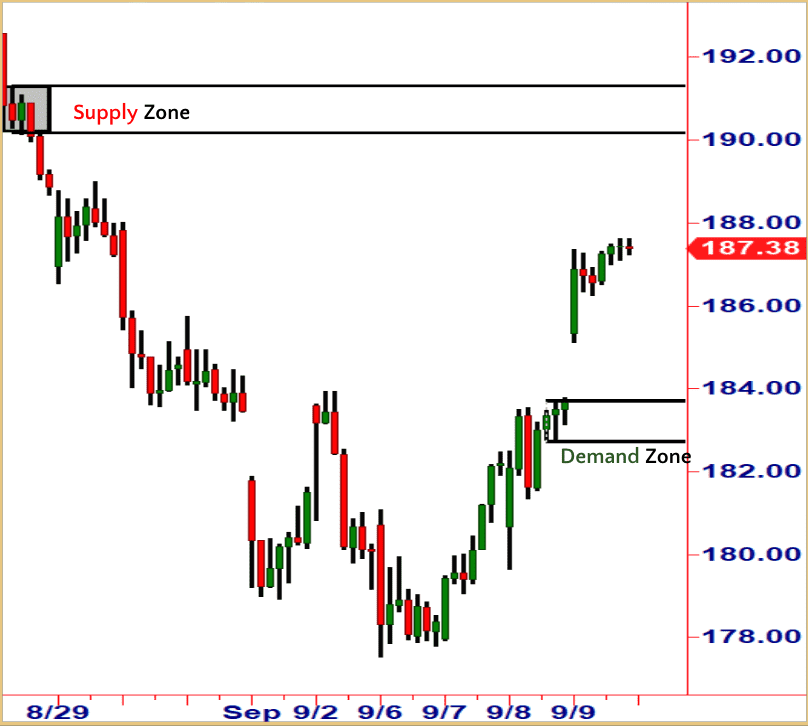

Now that we have reviewed this concept, let’s focus on the next. A common question we receive is related to if the RTH levels are hit in the ETH of trading. Look at this chart below and we will explain further:

On this chart you can see some of the areas are in white while the other areas are shaded in grey. The white areas you can see are Regular hours (9.30am to 4.00pm ET) and the grey areas are the extended hours outside of the RTH. The grey sections are bigger because the ETH session is longer in pure hours than the regular session.

You will notice that supply and demand zones are created throughout both sections but in this case, we will be focusing on the white areas for our zones only, as these represent the highest volume opportunities. We have marked out a quality zone of demand on the far right of the chart, with little basing and clean structure. Now that this has been highlighted, we will be waiting for price to return to this level in the future for a trade setup. Ideally, this will happen during the RTH.

In this next chart however, we can see that the zone was hit overnight first, before being hit in the regular hours:

This is the question we get regarding this exact situation: “Are regular hours levels still valid if they have been hit pre-market or overnight?” The simple answer is yes, they are still valid.

The primary reason we favor RTH chart levels is because they have been created on higher volume, as we discussed earlier in the article. Yet there is another reason why they are preferable. RTH charts also line up with stock charts and ETF charts. This example we are looking at is of the ES Futures. The ES futures runs in line with the SPY ETF, as they are basically the same product or market, just in a different format. The SPY is one of the highest traded products in the world and only trades during the RTH. Therefore, when we trade the RTH chart of ES, we are lining up our zones with the same zones on the SPY, meaning their probability of holding is even greater.

As we can see, later that day when the regular market was open, the same demand zone was triggered and held just fine:

We must almost imagine that the ETH activity does not exist when we see a scenario like this. All that matters is where the markets open when the 9.30am bell rings. Whenever levels look like they have triggered overnight, remember they can still be used during the cash market session. Take note though: these RTH zones should only be used when hit during the RTH itself.While it may seem a little complicated initially, this concept is worth getting your head around and it will, in time, simplify your day trading in many ways. In our world, simpler is always better! TRADING & INVESTING IDEAS

CAD/JPY – Canadian Dollar vs Japanese Yen

The Setup:

Currently in fair value, this pair has some untested levels above and below the range. Lack of fresh demand offers great downside potential rewards.

The Logic:

In times of weakness, the larger profit potential trades will be offered at supply. Finding zones outside of current Fair Value will always provide better setups.

The Zones

EUR/AUD – Euro vs Australian Dollar

The Setup:

This currency pair is ranging right now but has supply and demand zones outside of the current range for setups both above and below. The lack of market direction makes both supply and demand valid in this case.

The Logic:

Fresh and untested zones are typically the better opportunities, as the imbalances are likely stronger and offer the higher probability ad greater reward.

The Zones:

Simple Rules for Simple Trendline Strategies

Trendlines are an interesting concept. On one hand, they are foundational to price action itself and are key to analysis. Markets trend constantly, both up and down and trendlines are a great way to mark off these important market stages for both entries and exits. On the other hand, they can be incredibly subjective when being drawn. Much is based upon what we think we see, rather than what we objectively recognize from price. There are schools of thought which state that a qualified trendline needs at least 3 points to be confirmed. Others believe that a simple break of a trendline means the trend is over. Let’s make things a little cleaner.

First, if you wait for 3 touches to confirm a trend, then you will likely be joining it too late and missing much of the action. Instead, we like to use 2 initial anchor points and project the trendline forward. This gets us into the action sooner. Secondly, a break of the line may just be a false signal to run stops. Therefore, we would look for a close above or below the trendline to confirm it is over. Look at the example below for a better idea. They are a great tool, but to fully make use of them, you must be more proactive and logical in their implementation

Synthetic Stock: The benefits of stock ownership… without the cost

For over a century Americans have looked to the stock market to generate wealth and fortunes. However, for many people the stock market has been out of reach, perhaps never more than now, because of the cost of the stocks people want to own.

Buying one hundred shares of some stocks can be prohibitively expensive. As of 01/06/2023, one hundred shares of Netflix, at $313 a share, would set you back $31,000. Facebook (Meta), $13,000. One hundred shares of Google, post split, would cost almost $9,000.

What if you could get almost all the benefits of owning the shares, of being long stock, for a fraction of the cost?

If you buy one hundred shares of any stock, you’ll get a dollar of profit for every dollar the stock rises. But you have to shell out a lot of money to buy the shares, taking on potentially large risk if the stock tanks.

However, what if instead of buying the shares outright, we could get creative, and create a “synthetic” long stock position that would also profit dollar for dollar as the stock rises?

By buying a call option, and selling a put option, (both with the same strike price and expiration date), we can participate in a stock’s move with, in many cases, very little upfront expense.

Understand, this is a bullish trade that should be entered only when you have reason to expect the stock to rise, at a demand zone. Whether buying actual stock to create a long, bullish position, or buying a “synthetic” bullish stock position, we need the stock to rise to profit, and we’ll take a loss if it drops.

In the below example, ZM is at a demand area at $65, and we’d expect the stock to rise from demand. At the current price of $65 a share, one hundred shares would cost $6,500. And if we’re following prudent money management rules, even if you were willing to put only 10% of your account in one trade, you’d need a $65,000 trading account. For 20% of the account at risk, you’d still need a $32,000 account.

Long calls are bullish as it gives the buyer of the call the right to buy the stock at that strike price regardless of how high the stock goes. Short puts are bullish as it obligates the seller to buy shares of stock at the strike price if assigned. Whether you have the right to buy a stock, or are obligated to buy a stock, you must be bullish, and you need the stock to rise to profit, and you’ll take a loss if it drops.

Let’s go out to May and buy a May 65 call and sell a May 65 put. We’ve entered two bullish positions for a fraction of what it would have cost to buy one hundred shares.

Let’s do the math:

Synthetic Stock Long Stock

BTO May 65 Call $10.20

STO May 65 Put $9.60 100 shares $65/share

Net Debit $0.60 Net Debit $6,500

Options are sold in contracts which give traders the rights and obligations to trade shares in one hundred share blocks. A debit of $0.60 would cost $60 per contract.

Which is more cost effective? $6,500 for one hundred shares, or $60 for one contract? Some of you must be thinking… what’s the catch? There’s no catch. Options are a leveraged asset. Even if you just bought the May Call option for $10.20, that’s only $1,020 for the bullish call option, as opposed to $6,500 for the one hundred shares. Again, leverage.

Even if we bought a deep in the money call option, with a Delta of 1.0, the cost is only $31.00, or $3,100 for the contract, which is still less than half the cost of buying the one hundred shares outright.

How do we profit from the actual position or the synthetic position? Say our profit target was $80. If we bought one hundred shares at $65 and sold them at $80, we’d realize a $1,500 profit on our $6,500 investment. A solid 23% rate of return.

Cost Value at Target Profit

Long stock $65 $80 $15

Let’s do the math on the synthetic position with the stock at $80 at expiration.

Cost Value at Expiration Profit

May 65 C +$10.20 $15.00 $4.80

May 65 P -$9.60 $0.00 $9.60

Net Debit: $0.60

Net Profit: $14.40 – $0.60 = $13.80

With the stock at 80, the 65 C will be worth $15, showing a profit on the call, and as long as the stock closes over 65 at expiration, the 65 P will expire worthless, resulting in another profit on the put.

If you liked a 23% ROR on the long stock position, how about a 2300% ROR on the synthetic stock position?! The profit was $13.80 on a $0.60 investment.

Now, as there are no guarantees in life, and any trade can go against us for any reason, let’s look at the downside risk. The max loss on the stock if it went to zero is $6,500.

Max loss on the synthetic position? The most we could lose on the 65 C is $1,020. And the max loss on the short put, if the stock went to zero, is $6,500. However, we sold the put, and collected, $9.60, or $960 at entry, so the most we could lose on the short put drops to $5,540.

Max loss long 65 C $1,202

Max loss short 65 P $5,540

Net Max Loss: $6,742

So, while the synthetic position has a slightly larger max loss, in reality, we’d never ride a stock down to zero, and we had to tie up substantially more money to enter the trade.

If we expand our notion of what exists, of what is possible, options can give us multiple ways to profit in the markets while minimizing risk when trades don’t work out.

Of course, it is imperative to understand how options work in addition to the rules of supply and demand. For those that would like to learn more about options, look to attend the next Pinnacle options class, or join us Monday afternoons in the Arena.

12 Rules for the 12 Months Ahead – Part 2

We hope you had an incredibly happy holiday season and are excited for what is to come in 2023! Two weeks ago, we shared the first half of our top tips for the coming new year. As promised, here we have the second half to implement into your trading plan for 2023.

7 – Trade Price not Indicators

The Pinnacle Method of analysis and execution should always be your primary decision maker. It can often be tempting to bring extra indicators into the mix, but be cautious.

One of the dangers of relying too much on these secondary tools is that they require price to give us a signal. This will always result in a lag and delay in the signal itself. That delay causes the trader to get into a position far too late, and it negatively affects the overall risk and potential reward outcomes.

By focusing on price, we will typically get the best signals at the earliest time. If you know how to read price on a chart, you will understand how to recognize the true footprints of the major market players.

Institutions create patterns due to the imbalances of their order size compared to the retail customer’s order size. If you develop a keen understanding of this concept, you will know exactly where to get into the market for maximum trade potential. Price is the best leading indicator.

8 – Limit Your use of Technical Indicators

We should also remember that technical indicators, if used correctly, are a powerful tool to help the decision-making process. When utilizing supply and demand levels, sometimes we may find too many trading opportunities. Technical indicators can be useful in helping to filter these opportunities.

Technical indicators such as moving averages, bollinger bands, and other oscillators can give extra support to the supply or demand level opportunities. However, the technical indicator should not be the primary decision-making tool and should be used only after the trader has identified a qualified level based on the Pinnacle Method. If you are planning to employ technical indicators, choose one or two to aid you in your analysis process. This way, there will be little danger of focusing more on the technical indicators rather than price.

9 – Focus on a Few Timeframes

This point is short and simple: less is more. If you look at too many time frames when trading in any asset, you will find it harder to pull the trigger. As traders we need to be able to make decisions on the spot and with clear rule-based objectivity. More timeframes mean more complications.

Multiple timeframe analysis is a key skill which needs to be developed if you are to ever achieve overall consistency in your trading. We would look at no more than three or a maximum of four timeframes when trading. This will give you a broad picture of fair value and overall market direction. Using any more than this could potentially result in you forcing a trade, meaning that you flip through multiple charts to find an opportunity because you are desperate to take a trade, rather than wait for the right trade. Remember, trading really is a game of waiting.

10 – Keep a Trade Journal

This one always seems obvious, but it is surprising how many people have never thought about it before. We all come to the market wanting to trade, to get into the action as soon as possible to make money. The last thing we really think about is journaling and tracking our actions.

Well, here is some news for you: you need to record your activity in your trading. How can you ever analyze what you have been doing if you do not record what you have been doing? The only way we can learn about what works and what doesn't work is by keeping a journal of our trading activity and then learning from it. Start a journal now and track your performance from this day forward. Most traders are just looking for consistency, and the only way to truly become consistent is to be consistent. Your journal will help you achieve this.

11 – Don’t Become Isolated

Trading is a lonely business. Most new traders love the idea of making money on their own terms but forget that this also comes with the disadvantage of it being a very solitary career or activity. Other careers usually include going to work where you have breaks and communicate with others. When you're sitting at home in front of a computer screen, typically the only person you can talk to is yourself and let's be honest, self-talk is usually not a good thing in trading.

People need people. Our Pinnacle Arena is an ideal meeting place for our members. Sharing your goals with individuals on the same path as yourself often supports more successful results. Put yourself in a group with other like-minded individuals and emulate the success of people who are good at what they do. Going at it alone is not always the best course of action. We often forget that we are typically most like the people we spend most of our time with.

12 – Hold Yourself Accountable

As people, we are responsible for our own lives and the decisions we make. Trading is a decision-making process at its core and requires us as market speculators to take responsibility for the choices we make to buy, sell, and manage our risk. We all need to understand that our success is dependent on us and us alone. We are only trading what we believe about the markets and what we believe is true, isn’t it?

TRADING & INVESTING IDEAS

GBPJPY – British Pound vs Japanese Yen

The Setup:

The GBPJPY has seen a strong sell off, with a current recovery rally these last few weeks. The price is currently sitting at fair value with supply above and demand below. Both longs and shorts can be considered.

The Logic:

When markets are in equilibrium, there is no directional bias and both extremes can be considered. These ranges are ideal for low risk and high potential reward set-ups.

The Zones

166.13 – 166.99

LOW – Lowes Companies Inc

The Setup:

Lowes has been strong considering the broad market weakness over the last few weeks. This makes it solid for both buying and selling opportunities. It is in the middle now but when it reaches unfilled gaps, we have the signal to enter.

The Logic:

Combine ranging markets with gaps at supply and demand, and we have ideal trade entries. Gaps always represent the larger price imbalances and should be considered if they meet the required qualifying process.

The Zones:

Maintaining Risk Management Effectively

Most of us have heard of the 1-2% rule: never risk more than this percentage of your trading capital on a trade. This makes perfect sense and, depending on your frequency of trading, strikes a nice balance. A 2% risk on swing trades is ideal, as you should be taking fewer trades across the week or month. When it comes to day trading on the other hand, 1% to 0.5% risk per trade is ideal. There will likely be more trade opportunities in a day, leading to the potential for over-trading. Limiting the risk to a smaller amount can take the edge off a losing streak. However, it is vital to remember that the risk percentage should be seen as total exposure. Taking 1% risk on 5 trades at the same time is a total exposure of 5%, way above what we would recommend. Keep this in mind, and if you have multiple opportunities presenting themselves to you, the risk can always be split across them by breaking down the percentage you intend to risk. Also, if you are at breakeven on one of a group of trades, you can always enter a new position with the risk allocated to a new entry, letting you run the existing trade for free effectively.

Managing expectations is one of the most important skills a trader or investor can develop. When things are going well, we often want them to be better still. When the pressure is on and the losses are racking up, it can be just as difficult to know when to stop and live to fight another day in the markets. Good day or bad day aside, we need to always enforce discipline and manage not only our own expectations, but also what we can expect of the market. We have always been in support of classic technical analysis tools, but only when used in the right context. The Pinnacle Method will always provide our buy and sell signals.

Generating Cash Flow From Stocks You Own

We own stock for one reason: to make a profit. Most investors who are looking to profit from owning stock need the stock to go up to generate a profit.

However, what if we could use the stock to generate cash flow without the stock having to go up?

Once you own shares of an optionable stock, you can sell call options against that stock position that will have the goal of accomplishing one of two things:

Generating weekly or monthly cash flow.

Getting paid to sell your stock at a premium above the stock price you were prepared to sell the stock.

Many of you might be familiar with call options when buying calls. Buying a call option gives the buyer the right to buy shares of stock at the strike price no matter how high the stock goes up. However, when we sell call options, in exchange for collecting a premium, we’re taking on an obligation to sell shares of the stock at the strike price if it closes at or above the strike price at expiration.

The covered call strategy involves selling a call option at a strike price where you don’t think the stock will get to before the option expires. So, say a stock is trading at $217, and has been trading in a range, with the distal line of a supply zone at $219.

If the distal line of a valid supply zone is 219 and the zone holds, we probably wouldn’t be expecting the stock to go higher than that. What if we sold a 220-call option, and collected a premium of $2.05? We collected $2.05 a share, or $205 per contract, and in exchange we took on an obligation to sell the shares at $220, but only if the stock closed at or above $220 on expiration day.

And if the valid distal line of supply is 219, our expectations are the stock won’t get to 220, and we won’t have to fulfill our obligation to sell the shares. Here’s the best part, even though we don’t have to fulfill our obligation to sell the shares, we get to keep the $2.05!

Just like your insurance company gets to keep your premium when the policy expires if you don’t file a claim.

And if the option expires worthlessly and we don’t have to fulfill the obligation, what can we do AGAIN?

Sell another call at another expiration date further out and collect another premium.

And in the example below, you could have sold at least six 245 calls at the 245-strike price over a seven-month period… and collected multiple premiums, while never having the stock called away.

Now, while you’re generating cash flow every time you sell a call and collect a premium, you’re also lowering your cost basis on the stock you already own. And the “worst” case scenario? The stock rises above the strike price, and you must sell your stock. But you’re selling at a price above the supply zone, and for a premium because you collected money when you sold the call and took on the obligation.

Now just to be clear, the income generating covered call strategy we’ve discussed does necessitate owning stock and owning a minimum of 100 shares of stock. (Options give you the right or obligation to buy or sell shares of a stock in 100 share increments). So, there is of course the risk of the stock dropping and incurring a loss, potentially a large loss on the stock that wouldn’t come close to being offset by the covered call premium collected. Selling covered calls should not be used as a substitute for having a stop loss to protect the investment.

For more information on covered calls, or to learn how to implement the strategy, look into the Pinnacle Institute’s options class or investor program.

12 Rules for the 12 Months Ahead – Part 1

Another year is coming to an end. For some 2022 has been a good year and for others, an uphill struggle. No matter where you are, this is the ideal time to hit the reset button and get things in order to face the upcoming market activity of 2023. The very best signal of success or failure in trading is typically going to be down to the quality and implementation of our trading plan.

With the trading plan nailed down, you are inviting yourself to become unemotional. Remove the emotions and you also remove the temptation to trade without discipline. Nobody can ever predict what is going to happen next in the marketplace, therefore we need to have guidelines in place to tell us what to do when certain criteria and events occur. The end goal is to be consistent and see what works and what doesn’t work.

With the dawn of 2022 approaching fast, we thought this would be a good time to share with you the first half of 12 rules (the rest to follow in Part 2) that could be of use across the coming year:

1 – Manage Downside

Often overlooked and commonly misunderstood, risk management needs to be the priority that any trader has in their plan. The only way to make money, is to ensure that you have enough in your actual trading account to place a trade. The smaller the account the smaller the returns, therefore we need to protect our account because the more we have, the more we can protect and grow that account to make better returns over the long run. When the money is gone from our account, our trading career is over. That money in the account needs to be seen as a tool to produce a consistent return. This will never happen unless the money is protected at all costs. Follow the “3 Strikes and Out” rule to manage your drawdowns.

2 – Develop Entries Avoid being too tight with entries and allow room for the trade to work. Too often we see members setting stops too tight or making entries too narrow. This often leads to missed entries and quick stop-outs, only to see the market move in our predicted direction afterwards. Don’t be afraid to enter on large timeframe zones with smaller positions sizes and wider stops and entries. Give yourself a chance to be successful by avoiding overworking a zone and getting cheap on an entry. Remember that stops must be placed in defensive locations to avoid the stop hunters.

3 – Understand Profit Targets

Why would you ever take a trade if you didn’t know where you were going to get out for profit? Nothing is more frustrating than seeing profits forming on a position, only to then watch them go all the way back to breakeven or maybe even into a losing situation. One way to overcome this is to know before you take a trade where your profit target will be and how to do this as objectively as possible. Knowing when to get out for profit is just as vital as knowing when to get in for an entry. We use Fair Value as the initial profit taking area, regardless of anything else. Fair Value acts as a magnet for price and the middle of the nearest Fair Value region is an objective first target for maximum risk to reward.

4 – Trust and Be Patient

One of the easiest things to do when sitting at your computer is to click the buy or sell button, especially in a choppy market. Impatience is a killer in trading. When we see an area of demand, we know that we should be buyers and when we recognize an area of supply, we set up our orders to sell. It is as mechanical as that. If solid levels don’t present themselves to us, then move on to another market or come back another time. Patience is a virtue in this business.

5 – Respect the Fundamentals

While the Pinnacle Method is rooted in pure price action trading, we shouldn’t ignore fundamental relationships. There are many intricate fundamental relationships present between the US Dollar and other related markets which can help to increase the odds of success when trading. Knowing the impact of the US dollar and Oil on currency, as well as a variety of other markets like bonds and stocks, can help the disciplined trader to know how to better time their entries. However, we must also recognize that sometimes that the inverse relationships do not work. Always trade objectively and use correlations as a probability enhancer, not a guarantee. Take trades because of the setup itself and not because of a fundamental relationship alone.

6 – Use News the Right Way

News can lead to great entries at qualified supply and demand areas. It can also drive sentiment so powerfully that levels get blown through in the blink of an eye and make us question our trading decisions. Nothing should impact your emotions in trading, especially the news. Regardless of the news report, plan and execute the trade as normal. Don’t think about the outcome, focus on the process. Sometimes you will get the result you desired and other times you will feel like you couldn’t be more wrong. It doesn’t matter. None of us knows what will happen in the next few minutes, so we play the odds in our favor and never deviate from the plan we’ve set under any circumstance. Avoid reading too much into the news and sentiment and stick to what the chart shows you. After all, if the news was the answer, anyone who could read would be a successful speculator.

Look out for Part 2 of this series in the coming weeks of Pinnacle Pointers. Happy Holidays to you and your loved ones!

TRADING & INVESTING IDEAS

GBPUSD – British Pound vs US Dollar

The Setup:

The GBPUSD has seen a strong recovery rally these last few weeks but is reaching Weekly Supply, with the US Dollar also at Monthly Demand. This will test the integrity of the downwards momentum with a short at Daily Supply.

The Logic:

Large time-frame levels combined with inverse help are high probability setups. Selling at Supply with momentum on our side, also helps the odds of the trades.

The Zones

1.2486 – 1.2558

IWM – Russell 2000 ETF

The Setup:

Broad Market weakness offers an opportunity to sell at new Supply as new lows are being created. The IWM has been leading the pack to some degree, making it the best short play for now.

The Logic:

In times of weakness we sell, and we sell the weaker of the markets. Using a Supply zone which created a Gap in price, also suggests a major imbalance at the entry area.

The Zones:

Expectations and ATR

Managing expectations is one of the most important skills a trader or investor can develop. When things are going well, we often want them to be better still. When the pressure is on and the losses are racking up, it can be just as difficult to know when to stop and live to fight another day in the markets. Good day or bad day aside, we need to always enforce discipline and manage not only our own expectations, but also what we can expect of the market. We have always been in support of classic technical analysis tools, but only when used in the right context. The Pinnacle Method will always provide our buy and sell signals.

However, any supplementary tool to aid us in our objective analysis and enhance performance is welcome. This is why the Average True Range (ATR) indicator can offer some assistance. The ATR is helpful because it gives us an idea of the expected range of the current candle bar. For example, when used on a weekly chart, it shows the expected range of that week. If used on a 60-minute chart, it would detail the expected range of that hour and so on. On a daily chart it would look like this:

The highlighted ATR reading shows $6.11, which is what the average daily movement is expected to be, based on current volatility. This reading will change as volatility changes but gives a general idea of what to expect.

With this in mind, when we have large moving days, it can stop us from chasing price when we are at the ATR extremes. In the chart above, we can see how after a strong rally into the marked supply zone, it was better to consider the short rather than chase the long. We had reached ATR extremes and hit daily supply. Obviously, markets can move well beyond the current ATR reading but this still gives us an objective way to manage our expectations for the next move coming and how to plan in a disciplined manner.

Check Yourself and Your Challenges Before You Start Trading

Most people want to get involved in self-directed trading because what they focus on is the ‘amazing new life’ all the profits from trading will provide. This thinking, while typical, is very dangerous. It is usually filled with blind spots that always guarantee that the profits you dream of, will instead be losses and a nightmare. It is critical to first focus on the challenges you will likely endure, and have a plan for them before you start trading. The group that focuses on the ‘prize’ tends to lose their money to the group that focuses on the challenges. It is one group who is providing income and wealth for the other- that’s trading. While there are many potential challenges, we will focus on two that we believe are key.

Self-Control

If you don’t have self–control (discipline) in other parts of your life, don’t think you will magically have it when you start trading. In fact, trading will challenge your discipline more than you can imagine.

From birth, we run to things that make us feel good and run from things that we are afraid of. Proper trading and investing actually requires you to have to think the opposite if you want to succeed. Here’s what we mean…

We want to buy low and sell high, right? Well, to buy low (when prices are cheap), you need to buy when most people have sold. When that happens, you will be experiencing red candles, down sloping indicators, often accompanied by bad news, and so on. The act of buying low and selling high is NOT comfortable when trading and investing.

Profits and Losses

People love profits and do not like losses. This often leads to people taking profits quickly when they have them, and refusing to take losses because they simply do not want to lose. This action is quite common and typically leads to a short trading career. Successful market speculators tend to take losses quickly, when their plan tells them to, and they hold onto gains until they reach their pre-determined profit target. In other words, they plan their trade and execute their plan. For investors who only buy and hold in the stock market, they typically buy with no plan for risk and no plan for profit. Having a plan for both results is crucial.

Before you embark in you trading and investing pursuits. Be sure you check your challenges, or your challenges will be sure to check you.

TRADING & INVESTING IDEAS

SBUX – Starbucks Inc.

The Setup:

SBUX is trading near the middle of a very large Profit Zone with a very qualified Supply zone above and Demand zone below.

The Logic:

Typically, the larger the Profit Zone, the higher the probability price will turn at these zones.

The Zones

109.80 – 111.90

GLD – Gold Trust ETF

The Setup:

GLD has rallied strong from a Demand Zone with plenty of room above to the Supply Zone.

The Logic:

Notice the strong rally as price moved away from the Demand Zone. This typically represents a large Supply and Demand imbalance at the zone.

The Zones:

BA – Boeing

The Setup:

BA is nearing a Supply Zone above with a Demand Zone quite a ways below. Profit zone is key here.

The Logic:

This opportunity offers a large Profit Zone. Profit Zone and Probability go hand in hand. The larger the Profit Zone, typically, the greater the Probability.

The Zones:

Economic Reports and Price

Every month we have economic reports released by the government during market hours or during pre-market trading. These are often triggers for significant market moves as new Supply and Demand comes into the market based on people’s perception of the report.

An unexpected number from the report invites a lot of Supply or Demand into the market. An expected number means the market likely will not move much, as little new Supply or Demand comes into the market.

Notice the NASDAQ chart above. Price declines to our qualified Demand zone the day before the Fed (Federal Reserve) report. This is when we can buy with a lower risk, higher reward, and strong probability long entry. The next day, the Fed report came out, the news was bullish, a lot of new Demand came into the market and the market rallied strong.

The key for today’s lesson, which is a common occurrence, is this…Often, price will trade into a qualified Supply or Demand zone the day BEFORE the key economic report comes out. Most traders try and trade when the report comes out and run into quite a bit of trouble as price can move far and fast. Most people don’t see the lower-risk entry the day before the report, when it is often available.

Let The Market Lead Us

You have likely heard people tell you to “let the market guide you” when trading and investing, but do we really know and understand what this means? Typically, this is in reference to understanding and analyzing the price action of the market. The term “price action” can be confusing as a concept to grasp initially, so let us take a simpler look into ways to both understand price action and use it to our advantage.

When we attempt to define the concept of price action, in simple terms we are looking for evidence of market strength, weakness or equilibrium. The Pinnacle Method focuses on the major turning points which are created as the result of market imbalances.

These areas, without question, will always offer us the greatest opportunity to enter trades with the lowest risk and the highest potential reward. However, when combining both qualified supply and demand zones, with an understanding of price action, we potentially have a powerful combination.

The key to making things simple is to first define strength, weakness, and balance. Strength will be shown when prices move higher in an upwards trend. Weakness is when the market is falling lower in a downtrend and equilibrium can be seen when the market is ranging. When we see sustained movement higher or lower, it makes sense to follow the momentum. When the market is ranging, or in a prolonged state of fair value, we aim to play the extremes in both directions.

The next step is to combine this plan with using our supply and demand areas with price action study. For example, in strength we should look to buy pullbacks to quality demand areas. In times of weakness, we short rallies into qualified supply zones. Finally, we can enter at both supply and demand areas with conservative targets when the price action is showing fair value.

Often you will find that you must wait things out when market direction is far from clear. This scenario was present recently when we were analyzing Corn Futures (ZC) for a setup in the Close Exchange. At the time of analysis, the corn market was clearly in a state of fair value, or equilibrium. Here is a shot of the chart below, on a daily timeframe:

Now while there is nothing wrong with playing the range at either extreme, we should remember that eventually the market is likely to break one way or the other. Guessing which way this breakout will be, is just what it sounds like: guess work. You will also notice that the marked supply and demand areas are not of the highest quality either, meaning that leaning on these areas too much will decrease any odds of success for these areas to hold.

With this in mind, the best course of action moving forward, is to simply wait for the market to lead us. Should ZC break higher or lower, it will potentially form a new area of entry for our consideration. A few days later, that is exactly what it did, as shown below:

Draw your attention to the prior demand area which was broken as the price moved lower. We can see that when this area was broken, the market created a new area of supply. Think about why this is important. There were more buyers in the area before the break of price support. However, when the buy orders were all absorbed, this would have required an abundance of supply. These sell orders (supply) created their own zone in the same area as the previous demand.

We look at areas like this, as transition areas, meaning that it can be objectively assumed that the initial imbalance of buyers to sellers, then became an area where the sellers now overwhelm the buyers. This new supply zone can then be used as an opportunity to sell short on corn futures, after the market showed clear weakness from the break of previous price support.

Waiting for the market to guide us like this, requires both patience and discipline for traders and investors of all experience levels. Often when a market breaks higher or lower, we are tempted to chase price, only to watch it pull back and stop us out. The alternative is to wait things out, allow the market to show its hand and act accordingly. The morale of the story: always trust and be patient.

TRADING & INVESTING IDEAS

DVN – Devon Energy Corporation

The Setup:

As the broad markets are determining their next direction on the larger timeframes, we can see DVN has been marking its own territory, with swings higher and lower. In this instance we can play both sides of the market.

The Logic:

Without clear, broad market correlation, it makes sense to look for equities, which are mostly directionless. In this instance, DVN fits that requirement and gives us quality opportunities to enter at both supply and demand.

The Zones

77.14 – 78.77

FTNT – Fortinet

The Setup:

FTNT has been showing some slight weakness over the last few quarters but has recovered recently and is now offering opportunities at both supply and demand areas for long and short plays.

The Logic:

The supply zone on this chart offers an unfilled gap with some secondary evidence to complement. Shorting at supply in the extremes of a range is ideal. The lower demand area although tested slightly, is a great representation of wholesale demand, which can also be considered as a buying opportunity.

The Zones:

When to Widen the Net

Near-misses in trading can be a frustrating occurrence. Think about those times when you have done the analysis, qualified the zone and set up the trade. You followed the rules. You set your stop losses and targets, letting things play out as they should. However, a little later when you came back to check how the trade played out, you see that your entry was almost too good! By too good, we mean the price almost touched your zone within a whisker and then worked out perfectly, leaving you behind to see the move happen without you. This happened at a recent level we were ready for on Gold Futures (GC) only last week, shown here:

The upper supply zone triggered perfectly, only slightly piercing the entry line, before dropping to the opposing level of demand. However, the demand zone offered a great buying opportunity, which almost triggered, but then went without us. Sometimes you must accept this, however, a good practice if this is happening regularly is to make some slight adjustments to the entry.

In the Pinnacle Method course, we recommend setting your entry a little earlier than the proximal line. We suggest around 10% of the size of the zone as a benchmark. It could be useful to keep a record of how much extra room you give on your entries, so you don’t miss these opportunities in the future. Obviously, it will compromise your risk to reward ratio but if your entries are too tight, and are costing you winning trades, an adjustment like this could be a smart consideration to make.

Are Options Riskier Than Stocks?

In previous newsletters I’ve pointed out all the benefits options have over stocks. From leverage, to increased rates of return, to even being able to have the ability to profit when wrong directionally on the trade.

Yet, for all the benefits that options bring to traders and investors, options have the reputation of being the riskiest asset. While every asset has risk, even “safe” mutual funds, why do options have the reputation of being the riskiest asset?

Well, it turns out that most options traded expire worthless. So, is that a good thing or a bad thing?

To expire worthless, options must have something that no other asset has, and they do… They have an expiration date. So, when trading options, you not only have to be right about the trade, but you also must be right with the clock ticking. You must be right before a deadline.

Stocks don’t expire, if you buy a stock, do you care how long it takes to get to your profit target? If you don’t get stopped out, how long can you stay in the trade? Forever!

Trading stock is like a baseball game, because theoretically it never has to end. If you’re down 5-0 in the bottom of the ninth, nobody on base, two outs, with two strikes on the batter, is the game over? Nope. If you don’t get the third out, and keep getting hits, you can come back and win, no matter how long it takes. There’s no expiration to a baseball game, there’s no clock ticking.

You could buy a stock like CROX, which in 2007 dropped from $75 a share to $0.79 a share in fifty-four weeks! And it did come back… 14 years later, in January 2021, it was back at $75! Could you have held on all that time?

But if you’re down 17-0 in a football game with thirty seconds on the clock, the game’s over. You won’t even get the ball back three times, let alone score three times.

So, while trading stock is like a baseball game, trading options is like football, basketball, soccer, or hockey. You not only have to win, but you also must win with the clock ticking. Who remembers that game show from the 70’s, “Beat the Clock?”

Now, is it a good thing or a bad thing that most options expire worthless? Well, it depends on whether you bought or sold the option.

How do you make money in America? For most people, anything you buy, you need it to go up in price to sell it for more than what you paid for it.

Most Americans are bullish, and buy stocks and/or mutual funds, hoping to sell it for more than what they paid for it if the price rises. But if something you bought drops, and eventually becomes worthless, well, that’s a very bad thing.

However, what if you sold short? Then expiring worthless is a beautiful thing! When selling short you not only wan the stock to tank, but you also want the stock to go to zero! You want the company in bankruptcy before the trade settles!

As I mentioned earlier, the majority of options expire worthless, and for those who bought options, if they expire worthless, they not only take a loss on the trade, but they also lost 100% of their investment.

Stock traders rarely, if ever, lose 100% of their stock investment. Why? Because a stock must go to zero for that to happen, and most stocks don’t go to zero.

Zero is zero, right? So, what’s the difference? Well, while zero may be zero, when buying call options, which are bullish options giving the buyer of the call the right to buy stock, the stock doesn’t have to get anywhere near zero for the call option to be worthless at expiration. The stock just has to drop below the strike price of the call option.

In the above example, TSLA closed at a demand area at around $210 a share. If a trader bought shares of TSLA at $210, the stock would have had to go to zero for the trade to be worthless.

However, if an options trader bought a 210-call option, expiring in 90 days, regardless of what they paid for it, the stock would just have to close at or below $210 at expiration for the option to expire worthless. TSLA wouldn’t have to get anywhere near zero for the trade to be a total loss. If the stock did nothing, closed in ninety days where it was the day they opened the trade, the option would expire worthless for a total loss on the trade.

In other words, say a novice trader doesn’t understand the mechanics of options, time decay and volatility, or what happens to option premium as the option gets closer to expiration, they could be starting at a total loss, without ever getting stopped out on the trade!

At the Pinnacle Institute we’ll show you not just how supply and demand effects price movement on the stock, but how to effectively trade options so that when an option expires worthless, it could end a profitable trade for you.

Adapting to the Globex Trades

Consistency in trading is critical to progress. Changing rules and strategy repeatedly will only lead to confusion and frustration for most traders, causing their morale to decline. By being consistent, the trader discovers if something works or if it doesn’t. Read that back to yourself: The trader needs to discover what works and what doesn’t work. Engaging in a repeatable process every day in trading is what allows traders to reach this consistency.

Twice a week, we hold the Open Exchange sessions, focusing mainly on short -term trading opportunities which may trigger at or around the US Stock Market open. Many trades do hit within the first 30 mins of the day. Other times, they hit later. The important thing is that we look at the market through the same filter each day. This gives us a consistent routine.

Part of this filtering process is using the Globex overnight range as part of our strategy. For many years, the Globex prices have been very important in terms of trading. They highlight the overnight action and trading outside of the regular 9:30 AM to 4 PM eastern time trading session (also known as the cash session). When the US market closes, the Asian markets open for trading a few hours later, followed then by Europe, and then the United Kingdom. This worldwide trading activity is represented in the range of the Globex and can be influential when the US market opens the next day.

We have always regarded the Globex range as a representation of global sentiment before the US open. With the US market being the final market to open globally, the Globex range can be used as a metering tool, as to whether we will see strength, weakness, or indecision in the coming trading day. Every day we mark off the Globex high and the Globex low before the 9:30 AM open. These numbers are easily recognizable as they will simply be the current high and current low since the new session started.

After the range has been recorded, the concept is simple. We are looking to trap novice traders who are attempting to buy breakouts of the Globex high or sell breakouts of the Globex low. The key is to look for well-structured and prime location supply and demand zones above or below the Globex range for execution. On November 8th, we had two set ups of this kind which we can see below from the screen recording:

The green line represents the Globex High, and the red line represents the Globex low. Take note of how we have supply above the green line and demand just below the red line. These are predefined areas that are attempting to capture amateur traders buying or selling into these areas. Often these trap areas are triggered early in the trading day. However, sometimes they can trigger in the last few hours as well. If they are hit within the regular cash session, they are regarded as traps. These areas did not meet entry until later in the trading day, but as with many solid opportunities, they were worth the wait and patience played its part:

Both setups resulted in generous risk to reward profiles. However, we should draw attention to the size of the areas themselves. The demand zone below the red line offered a tight base with a good move away and a decent risk to reward ratio and was good to go. However, the higher supply zone above the overnight high was too wide for initial consideration and required us to drill down to refine the entry within the initial long wick on the 15-minute chart. We decided to drill down to a smaller timeframe to tighten the entry as we can see below:

In this illustration, you can see how the original 15-minute zone looked, and then how it was refined on the two-minute chart, to highlight the specific basing before the drop. Also, notice how the circled higher supply area was ignored even though the structure was good. This area was ignored because it was not part of the original 15-minute candle structure.

This concept is key. To be consistent in trading we must be consistent in our analysis. If we had decided to pick the smaller separate two-minute zone over the original 15-minute area, we would have deviated from our plan and would have missed the trade. The rule of thumb is to always use the larger time frame zones and drill down. We then need to avoid being distracted by what we see on the smaller time frames. Typically, these areas are more noise than anything else.

As a general takeaway when setting up the Globex trades daily, always begin with the 15-minute areas or higher. Never start on lower timeframes as they are usually less reliable. If you can’t see it on the bigger charts, it is usually not worth noticing. However, if we can drill and refine a larger zone with a smaller chart then we create superior risk to reward potential overall.

TRADING & INVESTING IDEAS

DIS – The Walt Disney Company

The Setup:

Disney has been in a weak-looking range for much of the last quarter and has a chance of re-establishing its range – the current zones offer both buy and sell opportunities.

The Logic:

When stocks are somewhat lacking direction, it makes sense to play both sides of the market, both long and short. Always ensure there are adequate profit zones on such setups.

The Zones

110.77 -114.41 and 124.57 – 127.35

SBUX – Starbucks

The Setup:

SBUX has recovered well from its lows earlier this year and rallied strong. However, we are now approaching Weekly Supply on both the stock itself and the broad market, which could increase pressure on the prices.

The Logic:

Weekly zones are powerful areas to play shorts, especially when backed up by broad market indexes in the same price patterns. Look to play the odds in our favor when this happens.

The Zones:

A More Reliable CCI

Oscillators can be a powerful analysis tool, especially when used with the Pinnacle Method as a decision-support tool. We would never recommend using them alone as a buy or sell signal. However, a great technique to use them would be as a “filter” for when to consider Supply and Demand zones for entry. The standard settings for the CCI (Commodity Channel Index), are 14 periods of data with overbought and oversold signals at +100 and -100. The downside of these settings is that the indicator spends lots of time giving an excessive number of signals, as shown below:

An easy fix is to simply slow things down by adjusting the OB and OS datapoints to +200 and -200. This way there are less signals with greater reliability. These signals can be used as a filter when considering major zones for both buy and sell opportunities. Refer to the example below:

Generally, for indicators, use more data for more reliable signals and to slow things down when used with Supply and Demand zones.

Drilling Down the Entry

The topic of this week’s article is the direct result of numerous questions we have received from members regarding the drawing of their zones. The beauty of the Pinnacle Method is in its simplicity. Supply and Demand will always be the greatest influence on prices. There is nothing more fundamental to price action than this simple yet powerful concept in trading. Highlighting areas of supply and demand, and entering at the greatest extremes of price imbalance, will typically always offer the greatest risk to reward opportunities.

However, it’s possible for the simplest concepts to have subtle nuances too. Wherever there is room for subjectivity, there is also room for error. It is vital that traders remain consistent in their actions and implementation of their trade plan. Typically, we find that most newer students of the Pinnacle Method initially have a hard time clearly defining the zones. Some will draw the basing areas widely, while others will keep these entry areas narrow. Is there a right or wrong way to do it? The answer to that question depends on which results you’re comfortable with: Higher reward-to-risk but less opportunities or lower reward-to-risk but better chances of meeting entries.

For example, if you keep your entry areas narrow with very tight stops, you have the potential to achieve very high risk to reward ratio outcomes. On the flipside, you will likely miss more trades because of a tight and narrow window of opportunity at the trading zone. When using wider areas around price imbalances the opposite is likely to happen. You would likely see more trades triggered and less missed opportunities, however the risk to reward ratio will be far smaller.

Ask yourself what you are comfortable with? Do you get frustrated with missing trades by a few ticks because of your narrow entries? Are you comfortable with being triggered on more opportunities and settling for lower reward ratios? It really depends on the individual. What is most important is to be consistent in whatever you do and measure the results accordingly. Let’s review both scenarios.

In a recent Open Exchange session, we highlighted a demand zone on the Nasdaq futures contract (NQ) which represented all the characteristics we look for when qualifying an opportunity. It had a strong move away, very little basing in the area of the candle clusters and finally, clean price action behind the zone. The trade itself didn’t trigger until the next day, but was a clean entry for a big rally higher, as we can see below:

Draw attention to how the zone itself was drawn. Both candles in the base, before the move away, were used. This is a great technique to use to ensure you capture as much of the zone as possible without getting too tight and missing the trade. Remember to draw the base to include the last candle before the explosive move away.

If we had used the smallest basing candle in the sequence, we would have missed the opportunity:

Like this example, notice how detrimental it would have been to “Drill-Down” to a much smaller chart to highlight the entry. In some cases, it makes sense to refine a zone on a smaller chart, such as to increase the risk to reward outcome. However, this can also lead to a missed entry too, as seen below:

It should also be recognized that if the smaller zone entry would have triggered, an incredible risk to reward ratio would have been produced. However, in this case, you would have missed the entry if you took the smaller zone, and you don’t make anything when you miss an entry.

When drawing entry zones, the most important factor is to be consistent in your process. As said earlier, if you are comfortable with fewer trades, more missed setups, but huge risk to reward trades now and then, that’s great. Stick to it. If missing a trade frustrates you, then give yourself a better chance to get in at the level by widening your entries. Strike a balance in your trade plan and give it a chance to work. Most importantly, repeat the same methodology over and over.

TRADING & INVESTING IDEAS

CSCO – Cisco Systems

The Setup:

Cisco has been building momentum over the last few weeks, creating Demand areas as it pushes higher. Look to buy pullbacks to demand zones to take advantage of the upside potential. The stocks also hit Monthly Demand recently.

The Logic:

The Tech Sector (XLK) had hit major demand which should help stronger tech stocks overall. When prices are moving higher, we look to buy at newly formed Demand zones along the way.

The Zones

49.68 -50.72

CRM – Salesforce

The Setup:

CRM has been making new highs since testing monthly Demand recently and looks to continue. We can reengage the upward momentum as prices potentially move higher.

The Logic:

When individual stocks are showing strength in a generally weaker market, we can increase our probability of success when buying at Demand zones. The zones can also benefit from an overall stronger sector (XLK) and their own higher time-frame zones being hit.

The Zones:

A simple note on Moving Averages

Moving Averages are probably one of the very first Technical Indicators ever created and to this day, they have remained very popular with Traders and Analysists. They can indeed be a useful tool if implemented the correct way and when you avoid relying on them for multiple buy and sell signals. They can be used in a variety of ways, (more of which to be discussed in a future article) and are a great tool to help the decision-making process and to filter trades, ONLY when used with Supply and Demand. At Pinnacle, we have often been asked which is the best Moving Average input of number to use? The answer is simple: It doesn’t really matter. The number itself is irrelevant as price will at some point revert to any numerical mean. What is more important to remember is one simple thing: The larger the data input, the more reliable the Moving Average will be as a support tool, as you can see on the diagram below. Whether it be confirmation of trend or for dynamic Supply or Demand, go with the bigger data input for a better signal.

How To Insure Your Financial Assets

Most people understand the concept of insurance. When you buy insurance, you pay a premium, and you’re buying the right to file a claim if something you own is damaged or destroyed.

The insurance company, in exchange for collecting the premium, is obligated to pay out on the value of the policy.

Having car insurance doesn’t mean you won’t total your car. Having home insurance doesn’t mean your house won’t burn down. All it means is, if your policy is paid in full, and hasn’t expired…you’ll get compensated for the loss. You did lose the asset, but financially you’re made whole.

You get a check! Why do you get a check? Is it because the insurance company likes you, or feels sorry for you? No, you get a check because the insurance company, in exchange for collecting a premium, is obligated to pay out on the claim.

So, if a group of adults were asked- Who has car insurance? Home insurance? Life insurance? Most hands would go up.

However, if those same people were asked- Who has stock insurance, IRA insurance, or even mutual fund insurance? They would have a very baffled look on their faces in response.

Considering that an IRA is probably the largest financial asset most people have (aside from a home, which as mentioned is insured against loss), and you asked someone why they didn’t have stock insurance, you’d probably hear one of the following responses:

- I’ve never heard of it.

- It’s not available.

- It doesn’t exist.

Now don’t go calling State Farm or Allstate and ask for an IRA or stock insurance policy. That doesn’t exist in that capacity.

So, if stock insurance doesn’t exist, how can you protect the value of a financial asset? How can you protect the value of your retirement account or stock portfolio against a crash?

PUT OPTIONS!

When buying a put option, you’re buying the right to sell a stock at a set price, a higher price…regardless of how much the stock drops.

What does that sound like? Insurance!

In this example, AAPL had just announced their quarterly earnings right after the market closed. AAPL just announced one of the most profitable quarters and released one of the best earnings reports in US history.

The stock closed that day before earnings at $130. And yet, within minutes the stock was already down almost $7 and over 5%…on amazing earnings. And to add insult to injury, the stock was down at $90 four weeks later.

Had you held the stock for the next month, you’d be down $40/share and over 30%.

However, what if in advance of the earnings announcement you bought insurance? What if you had purchased a put option? A put option at the $120 strike price.

What exactly did you buy? You bought the right to sell shares of AAPL at $120, no matter how low it goes. So, a month later when AAPL was trading at $90, you still had the right to sell your shares at $120!

You did lose the asset, the stock tanked, but financially you would have been able to recoup all or a large portion of the loss.

And what if the stock didn’t go down? What if the stock went up? Great, you didn’t need the insurance. Having insurance lets you sleep a little better at night knowing you’re protected, but you hope you never need it.

But how many of you hope to file a claim? How many of you are upset your life insurance policy hasn’t kicked in yet this year?!

At the end of the day, it is possible to protect your financial assets as easily as your house, car, boat, wine collection, or any physical asset you own against loss.

Now, when do most people find out they don’t have flood insurance? After the flood. While the concept of putting insurance on your financial assets with put options is an easy concept to grasp, you need to learn the intricacies of options to make sure you bought the right option, at the right strike price, with the right expiration date.

At the Pinnacle Institute, we work with our members to help them understand options. So, if they decide to buy them for investment or protection purposes, they know the right option to buy based on the situation if they choose to.

The Inside and the Outside of Gaps

Price gaps are commonplace in the global equity markets and can occur on a day-to-day basis. In fact, all financial markets can produce price gaps. This includes the Forex markets which are open 24 hours a day, 6 days a week. However, gaps in markets outside of stocks are less frequent and typically only occur over the weekends and at the start of the new trading week. When it comes to the stock market, we have a different scenario with gaps happening almost every day. The fact that the US equity market is only open from 9:30am to 4:00pm EST means that we can expect plenty of decent gap opportunity whenever the opening bell rings.

Depending on market conditions and, of course, the application of the Pinnacle Method, price gaps offer regular trading opportunities throughout the week if rules and processes are followed. Most novice market speculators simply follow the textbook rules of gap trades and nothing more. They usually buy when the market gaps up or sell when the market gaps down. These trades are usually taken for emotional reasons as most market speculators suffer from the fear of missing out.

Let’s face it, gaps up are usually the result of good news and gaps down are usually the result of bad news and people love to chase the action. Often as we know, this leads to losses and poor trading results. To overcome this hurdle, we need to do two simple things: Respect the laws of Supply and Demand (The Pinnacle Method) and remember that not all gaps should be treated the same. Let’s take a deeper look.

As Pinnacle members you should all be somewhat familiar with the terms and concepts of the Novice Gap and the Pro Gap. These two price structures offer great opportunities to enter trades at key Supply and Demand zones that were created with imbalances at the gaps. If you are reading this and are unfamiliar with these concepts, head over to the member dashboard and review the Pinnacle Method Foundation course for more information in the “Know Your Gaps” lesson. With this covered, let us look at gaps from a different perspective, namely the Inside Gap and Outside Gap.

Inside and Outside Gaps are also created on a regular basis and almost daily in the stock market. The terms “Inside” and “Outside” reference where the price gap opened in relation to the previous day’s trading range (the day’s high and low). Look at the example below:

In this example we have two gap downs. The first is an outside gap, because the price opened below the lows of the previous day. The second gap down on the right-hand side of the chart, is an inside gap, because the gap down opened within the previous day’s range.

In this example, pay attention to the first gap. Do you notice how the price gapped down below the previous day’s low and continued to push much lower? Some of you reading this will also notice that this is a novice gap scenario. Price was already trending down and then the market gapped down lower in the direction of the previous trend. Often novice traders chase this kind of price action only to see it reverse against them. However, in this example, the market gapped down and continued to go lower.

We must be cautious of novice gaps when there is a lack of quality supply or demand to stop it in its tracks. Often, we will see the price continue in the direction of the gap as the market forces build momentum. It can be frustrating as a professional trader when you are expecting the reversal on an outside gap day, only to see the market continually move one way. So, the question is how do we deal with them?

The best answer is to simply have patience and wait for the market to show its hand before acting. It’s more probable that we get our fingers burnt when chasing an outside gap by jumping into the apparent momentum only to watch the market reverse out of nowhere. We can avoid this by reading and identifying the newly created Supply or Demand that appears after the outside gap. Here is an example to consider from the previous chart:

Do you notice how after the gaps were created; they then produced a continued movement away from the base? We can describe these areas as Supply Gaps when we have a gap down and a continuation. If we can be patient and wait for the market to retrace to the origin of these gap movements, they offer us minimal risk with a defined entry and clear targets. The biggest challenge is to wait and not chase the price action!

Sometimes Price will pull back to these areas in the first 15 minutes of the open and other times an entry at the area will not be triggered for several days. Either way, these are quality areas for our consideration, as we can see from another recent example:

On this chart we have an example of the demand gap, a scenario where we had an outside gap up on the open and had to wait for price to pull back to the origin of the move for an entry long. The second is a supply gap from a few days ago, which offered an ideal short entry two days after it was created.

We can treat these supply and demand gap areas like we would any other supply or demand zone. The same rules for entry, stop loss, targets can be used. These set-ups can occur in any market but are most prominent in individual stocks and stock index futures. We hope this lesson is helpful to you.

TRADING & INVESTING IDEAS

MRK – Merck and Co.

The Setup:

MRK is trading in a wide range with of longer-term Fair Value. Look to engage in Supply and Demand zones at the extreme of the range itself.

The Logic:

When price is in relative equilibrium, we need to enter trades as far away from the mean as possible. Untested and well-structured zones offer this opportunity.

The Zones

94.37 – 95.35

K – Kellogg’s

The Setup:

Kellogg’s has struggled to find any long-term directional momentum and with this in mind, both long and short plays can be considered.

The Logic:

Like anything else in life, look to always Buy Low (wholesale) and Sell High (retail). This stock has established price extremes at Supply and Demand and these areas are ideal for entries.

The Zones:

A Simple Way to Trade the US Dollar

This year has not been a good one for most long-term investors. Most markets are still lower from the start of the year, and we have been seeing broad sell offs in a variety of commodities and currency pairs as well. One market that has been benefiting is the US Dollar. As you know, we use the US Dollar in the daily Forum as a major probability enhancer and inverse help. However, we have had many questions about how to trade it as a vehicle. While you can trade the dollar index futures, this would require a subscription to a specific exchange that is not suitable for everyone. Therefore, a simple solution would be to trade the EURUSD currency pair. Notice how the Dollar Index chart and EURUSD chart are inverse to one another? When one hits Demand the other will likely be hitting supply and vice versa. This makes the EURUSD an ideal way to engage in trading opportunities on the US Dollar indirectly. Safe trading!

TIME & PRICE

Time and price are a simple relationship most traders and investors think backward. And the backward thinking typically comes from conventional Technical Analysis. When it comes to identifying market turning points, most people look at a price chart and look for areas where there was a lot of trading activity. Thinking that when price revisits that area, it will likely turn and move in the opposite direction. However, if we think the simple logic through, we find that conventional thinking with time and price is completely backward.

Time and Price: The less time price spends at a price level, typically the more out of balance Supply and Demand is. The more time price spends at a price level, typically the less out of balance Supply and Demand is.

Let’s look at the trading opportunity above in which we identified in the DOW by following our Supply and Demand rules. Demand zone “A” is a Demand zone with very little trading in it (very few candles). In other words, price spent very little time at that level before trading higher in a strong fashion. This, along with it being a qualified Demand zone, suggested a large Supply and Demand imbalance. Which means when price revisits the zone, there’s a high probability that it will turn higher. Earlier in the week, price did revisit the Demand zone very briefly, then turned higher and rallied over 1500 points in two trading days. Notice it just barely touched the zone and turned higher. This is because Supply and Demand is extremely out of balance at the zone.

When looking for where price will turn and where it will move to (market timing), think about using simple logic instead of reading all the trading books and watching all the videos that are so readily available. Don’t be afraid to challenge conventional logic. If conventional logic doesn’t make sense, it’s probably wrong.

Who is Benefiting from Your Financial Decisions…You or Wall Street?

With so much volatility and uncertainty in the markets these days, the average investor is either confused or scared. The Stock market has been down much of the year, with many 401k’s riding right down with it. Wall Street professionals seem to be all over the place as well. Some major banks are calling for another 40% drop while others are looking for a 25% rally. Wherever the markets go from here, one outcome is almost certain…the Wall Street professionals’ profits will greatly exceed the average investors, whether the markets go up, down, or sideways.

Making major financial decisions that are truly best for you requires non – conventional thinking. There is a reason why the gap between Wall Street’s annual profits and the average investors’ is so wide. There is a reason why Wall Street revenues break records almost every year, and the average investor hardly ever achieves their financial goals. It’s simply a matter of how both groups think, which leads to the action that drives the results. The Wall Street professional ‘thinks the markets’ vastly different than how the average investor does, for whom Wall Street serves. Wall Street returns may be a big stretch for the average investor, but if you even want to get close you had better start thinking and acting like Wall Street.

Price is the one-word Wall Street doesn’t want you to think or ask about. The reason for this is because just about every financial decision you’re going to make requires you to buy something: Stocks from your broker or financial advisor, Annuities, Mutual Funds, Life Insurance Policies, and more. In all cases, you are essentially buying something from someone which means they are trying to profit from your decision. With Stocks for example, Wall Street owns the stock at a certain price and sells it to you at a higher price. That is one of the many ways they profit, from your purchase of the stock. Don’t blame Wall Street, this is how the system is setup. Instead, realize that the responsibility to make the right decision is on you. The goal is to first become aware of this issue, then understand how to make the right decision, and lastly feel comfortable and confident doing it.

The average investor almost never asks what price they are buying a stock. Make sure you buy it on sale, just like Wall Street does. Wall Street professionals suggest buying and holding, but are they doing that? Wall Street focusses on price more than anything else when buying stocks, bonds, and any financial instrument. The problem with “Buy and Hold” is it really means “Buy at Any Price in the Market and Hold with No Plan for Risk or Profit”. Does this make any sense to you? Do you think this is the strategy financial institutions use for their capital? Wall Street isn’t doing anything wrong; the average investor is. And this is simply because of a lack of understanding. So, it’s time to stop thinking and acting like an average investor and start thinking and acting like the big banks and financial institutions. Understand that how the investor profits in the financial markets is the same as how you profit buying and selling anything in life. Buy at wholesale and sell at retail. The answer is often found when keeping thinking simple.

Managing Expectations at Major Levels